An original technique for buying cheaper plane tickets

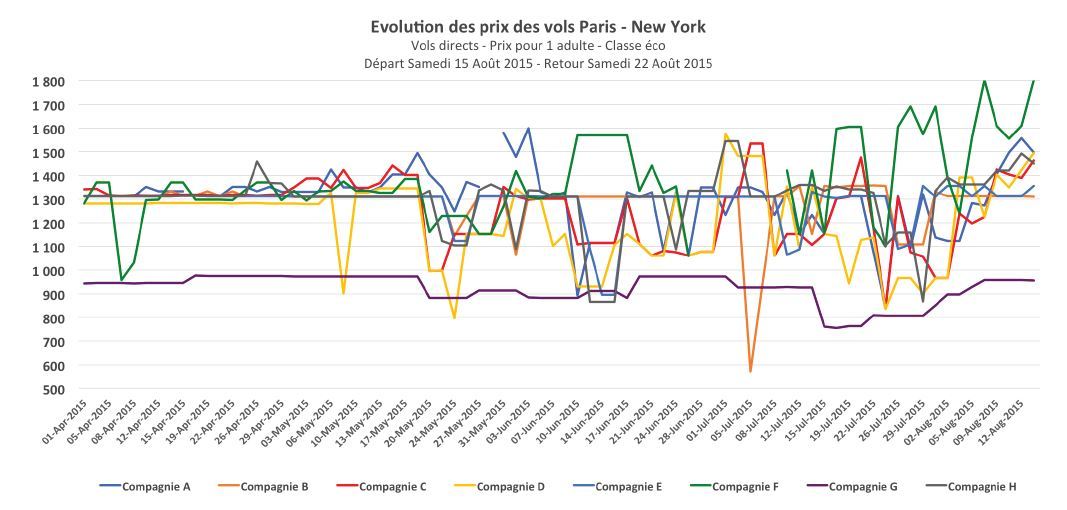

Put an option on a plane ticket and buy it only when it is the cheapest. That’s what Option Way, a travel agency that constantly monitors changes in airline prices, offers. Buying a plane ticket is like placing an order on the stock market. This is the idea of Mathieu Chauvin, the creator of the Option Way website. For this former financier, who has worked for Crédit Lyonnais, Ernst&Young and GDF Suez, among others, air ticket prices are strangely similar to share prices, with peaks and troughs that seem completely random, as shown in the graph below for a Paris-New York flight. This is what we call yield management.

(source: Frédéric Bianchi, 15/12/2015, BFM BUSINESS.com)

Does Yield really lower prices?

The small box attached to the article attempts to explain what the author calls « the very mysterious Yield Management » : « (…) hence the price fluctuations. To set prices, airlines use load factor grids. For example, if the rate is 40% 90 days before departure, the pace is good and prices will rise. If it’s only 20%, prices will fall ».

It’s actually a little more complex than that, for a number of reasons. Let’s try to get to the bottom of it.

First of all, many airlines are not going to lower prices if they are not filled to capacity, because :

- The principle of Yield remains fundamentally based on a rising price and not the opposite, even if there are of course cases where the price really does fall (poor estimate of the Yield, cancellation of a group, alignment with a competitor’s promotion, etc.),

- Yield does not aim for 100% occupancy, which is often unattainable depending on the season or day of the week. Airlines can accept low occupancy without lowering prices,

- Low fares often have apexes or delay outs (automatic closure of a class x days before departure regardless of the occupancy level) which prohibit the reopening of low fares,

- Yield fears dilution (a customer who was prepared to pay a high price will take advantage of a price cut to slip in),

- When prices do fall, it is neither systematic nor predictable. So how can we be sure that the price will fall? What level of risk does Option Way give its customers on the gamble of not buying their ticket now?

Price volatility and its interpretation

What’s not mentioned in the pretty graph, which shows great price volatility, is the type of price involved. A round trip ticket from Paris to New York during the week of 15 August can be understood in different ways:

- with or without the option of modifying the trip at the half-way point, and with or without a possible penalty

- with or without the option of cancelling the trip

- with or without luggage

- with or without the obligation to issue a ticket within 72 hours

- with or without open jaw (possibility of returning via Philadelphia, for example)

- and so on.

The price is only one component of the pricing offer; the conditions of use, issue, modification and service in the broadest sense obviously count in the act of buying. This is why airlines offer very different prices for the same seat.

For example, if the price today is 800€ for a pricing product that allows changes, and tomorrow there is a price at 700€ that prohibits changes, are we talking about the same offer, even if it is the same seat? These factors seem to have been ignored in the study, even though they can have a decisive impact on the decision to buy.

Flip a coin

The principle may seem appealing, but there are risks involved: if you have a time constraint that leads you to choose one airline rather than another, if you have doubts about your dates and need flexibility on your price, if you have baggage constraints, if you’re not a gambler… the risk may turn out to be too high.

If price is the only thing that counts and you’re prepared not to leave, give it a go!

Keywords: BFM BUSINESS, Frédéric Bianchi, Yield Management, Price, Airline